Financial statements have a crucial role to play in the business world. They keep the information about the transaction safe, and for this reason, it is considered mandatory for every business to issue financial statements. Banks also use these statements that are kept as proof by their customers because banks themselves have a huge database to keep the records safe for so many years.

There are so many documents a financial institute uses in a day. One of the most commonly and frequently used documents is a bank receipt.

What is a bank receipt?

It is a document that is provided to the customer by the bank when a customer deposits money into his or her account or the account of someone else. This document usually acknowledges the fact that someone has made a payment to the bank. People usually feel insecure when they pay anyone because they want the other person to give proof of the reception so that no one can refuse to have the money received. The bank issues and confirms that the payment has been received and the transaction has happened successfully.

Is it important to use a receipt?

Receipts or bills are very important to us because they document the transaction and also give each and every detail of the payment to the depositor. Sometimes, people send someone else on their behalf to deposit money on their behalf. In such a situation, that person has to give proof to that person that he has deposited the money. The receipt helps him a lot.

The receipts are also important to win the trust of the customer because having the receipt is a signal that the business also has the details of the transaction in its database, and if anything goes wrong or an error is spotted, he can easily use it to claim a resolution to the problem.

In addition, this document also includes the name and logo of the bank, which is proof that it is a genuine document.

What are the different types of receipts that are used by financial institutes?

There are thousands of transactions that are carried out in a single day at a bank. Every time a bank receives a payment from anyone for any purpose, it is the responsibility of the bank to issue the receipt. So technically, various types of receipts are used daily. A few of them are discussed below:

Deposit receipt:

It is a document issued to people when they deposit money in the bank. This document includes details such as the date of deposit, the total amount that has been deposited, the account number to which the money has been transferred, etc. Signatures of the depositor are also taken in some cases.

Payment receipts:

If payments are being made by people for any purpose, such as bill payment or paying tax, the bank prints the receipt and issues it to the person who has made the payment. The customer takes it as proof that the transaction has been successful, and there is no need to worry about it. These receipts also mention the amount paid, the date on which the amount was paid, a stamp from the bank to show the successful reception, and some other pertinent details.

Loan payment financial statement:

The person who has taken a loan from the bank usually pays it off in the form of installments. These installments are paid at the bank, and the customer fills out the form for the loan payment to indicate that it is a payment being made in an attempt to get rid of the debt. The debtor is required to keep all the receipts safe so that he will not be asked to pay additional installments after he finishes paying the loan.

Receipts for transferring money:

This document is given to the customer when he lodges an application with the bank for transferring funds from his account to the account of another person. These two individuals may be related to each other professionally or in some other way, and one of them may need to inform the other that money has been deposited into his account. In this case, he will present him with a bank-issued receipt.

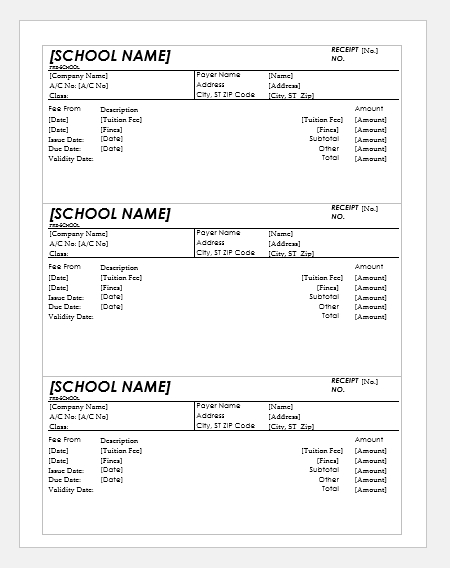

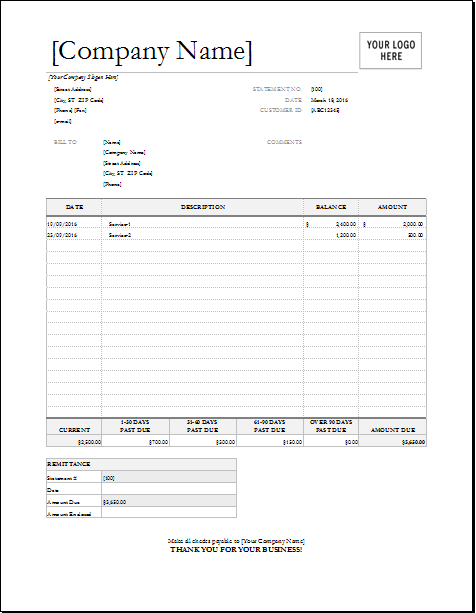

Sample